option to tax certificate

VAT1614C revoking an option to tax six-month cooling off period. There are two parts to the OTT the first is the decision and the second is telling HMRC.

My Website Monetization Blog Has Submitted For Us Tax Info Website Monetization Monetize Us Tax

Needless to say the paperwork in many cases will have been lost with the passing of time.

. John owns a factory and has an option to tax election in place on the building. This includes most tangible personal property and some services. A sales tax certificate is for exemption from sales tax you.

VAT1614B ceasing to be a relevant associate in relation to an option to tax. 15 May 2020 Form Exclude a new building from an option to tax for VAT purposes. 40 of the gain or loss is taxed at the short-term capital tax rates.

You can opt to tax one property at a time or all of the properties you own its your choice. A sales tax exemption certificate is needed in order to make tax-free purchases of items and services that are taxable. A tax lien certificate is a certificate of claim against a property that has a lien placed upon it as a result of unpaid property taxes.

Use form VAT1614C for revoking an option to tax land or buildings within 6-month cooling off period. The new company will then charge a commercial rent to the partnership of say 20000 a year plus VAT. If you have a tax exemption on file for the state you shipping to an option will occur to apply that tax exemption and remove tax from the order.

VAT1614E notification of a real estate election HMRC Notice 742A s 14. You should tell HMRC within 30 days of the effective date of the OTT but HMRC has always had the discretion to allow a longer period. The Company shall not without the prior written consent of the Lender.

This company would then make an option to tax election on the building and register for VAT so that input tax of 100000 can be claimed on the property purchase. We Dont Sell Tax Software or Tax Franchises. The Recipient shall not without the prior written consent of the Funder.

IDES only recognizes and accepts digital certificates issued by IRS approved certificate authorities listed below. Consult with a tax professional if. Ad Become a Tax Preparers within 8 weeks.

The public certificate should be included in the FATCA data packet transmission archive to the IRS. Section 1256 options are always taxed as follows. A sales tax certificate may also be called a resale certificate resellers permit resellers license or a tax-exempt certificate depending on your state.

Some examples of exemptions include homestead disability veteran over 65 renovations and energy incentives. 2 Post submission of request the Tax Certificate can. Unless the option is.

Once satisfied that the buyer can legitimately issue the certificate and the certificate is provided the seller has no choice but to disapply their option to tax. 60 of the gain or loss is taxed at the long-term capital tax rates. In this situation the strategy is blocked by anti-avoidance legislation see.

In New York volunteer firefighters qualify for an exemption while many states offer widows and widowers exemptions. VAT Option to Tax. 4 April 2014 Form Tell HMRC about a real estate election.

Certificate to disapply the option to tax buildings. Once satisfied that the buyer can legitimately issue the certificate and the certificate is provided the seller has no choice but to disapply their option to tax. Please ensure that your company name and state in your shipping address matches exactly what is on the tax exemption certificate no abbreviations letter for letter all spacing and punctuation precise.

Certificate to disapply the option. A purchaser must give the seller the properly completed certificate within 90 days of the time the sale is made but preferably at the time of the sale. The option to tax rules have been with us a long time since 1 August 1989 to be exact.

A tax lien certificate is a lien placed on your property for not paying your taxes. Use of option to tax forms and certificates can supply the same information in another format for example a letter. This means that many property owners will have sent their option to tax elections to HMRC and received written confirmation of those options many years ago.

This effectively disapplies the option to tax. You also have the option to spread your money around. In 1995 it made clear the circumstances in which it will accept a belated notification.

Therefore for sellers where this causes a real tax issue sometimes the only real option for the seller is to find a different buyer who does not intend to issue a certificate. VAT Option to Tax. Last updated on September 12th 2016 at 0342 pm.

It allows your business to buy or rent property or services tax-free when the property or service is resold or re-rented. Since 1 August 1989 those that hold an interest in a commercial property or land have had the ability to remove the usual VAT exemption that would apply to any use or disposal of that property or land this was always formally referred to as the election to waive exemption but more commonly. The IRS Public Key is a certificate that can be downloaded from the IDES Enrollment site.

Certificate to disapply the option to tax buildings for conversion into dwellings. Use form VAT1614C for revoking an option to tax land or buildings within 6-month cooling off period. The taxation of options contracts on exchange traded funds ETF that hold section 1256 assets is not always clear.

A tax exemption is a reduction of property taxes should the homeowner qualify. To notify the option businesses can either use form VAT 1614A see below or by HMRC concession see Legal update HMRC publishes revised option to tax notice and associated forms and certificates. The option to tax allows a business to charge VAT on the sale or rental of commercial property or in other words to make a taxable supply from what otherwise would be a VAT exempt supply.

You complete form VAT 1614A there are other forms in the series but this is the main one you need to worry about and send it to HMRC. Opting to tax is quite easy.

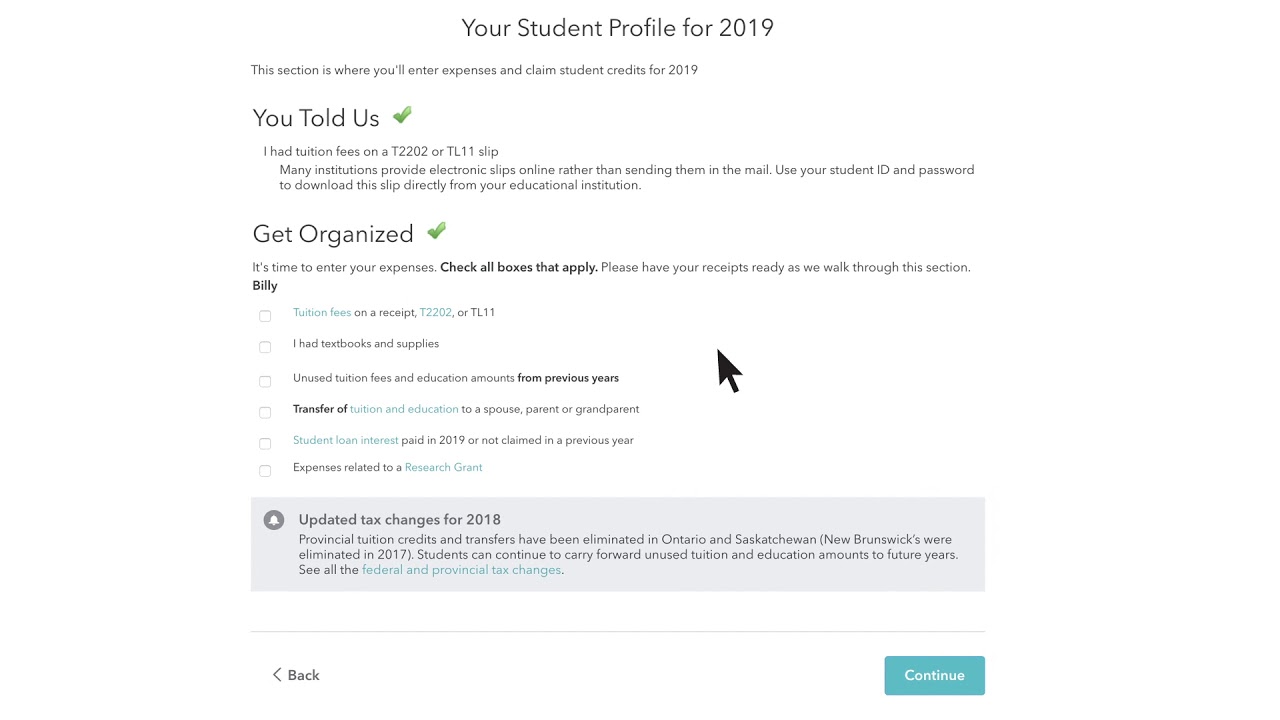

T2202 Tax Form Tuition Enrolment Certificate 2022 Turbotax Canada Tips

Pin By Authoress Precious Swain On Anointedforprosperity Taxtips Tax Preparation Online Web Certificate Of Completion

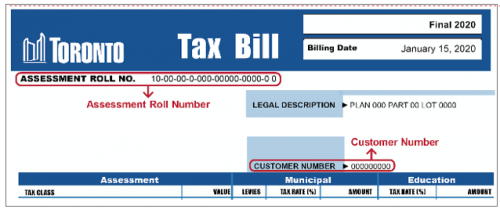

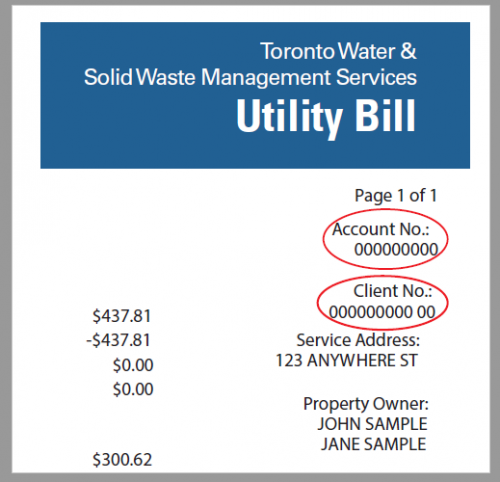

Tax And Utilities Answers City Of Toronto

Ap Deecet 2nd Phase Web Counselling Dates Certificate Verifications At Counseling Dating Certificate

Ap Deecet 2016 Counselling Rank Wise Web Option Process D Ed Admission Certificate Verification Dates Ssc Material Softwares Cgg Counseling Wise Admissions

Withholding Tax Certificate Form Number Thailand Localization Dynamics 365 Finance Forum Community Forum

Deductions Under Chapter Iv A Income Tax Return Life Insurance Premium Tax Deducted At Source

29 Rental Verification Forms For Landlord Or Tenant Being A Landlord Tax Forms Power Of Attorney Form

How To File Annual Income Tax For Employed People Winstar Technologies Income Tax Income Tax Brackets

How To Fill Out A W 4 Form Without Errors That Would Cost You Employee Tax Forms Math Models Proposal Writer

Browse Our Image Of Non Refundable Rental Deposit Form Template For Free Contract Template Certificate Of Deposit Payment Agreement

Tax And Utilities Answers City Of Toronto

Industries Which Acca Members Can Opt For Acca Study Business Valuation Cash Management Tax Consulting

Pin By Ash Prasad On General Fyi Gsm Paper Printer Types Laser Printer

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

Member Retirement Timeline And Checklist In 2021 Retirement Timeline Checklist